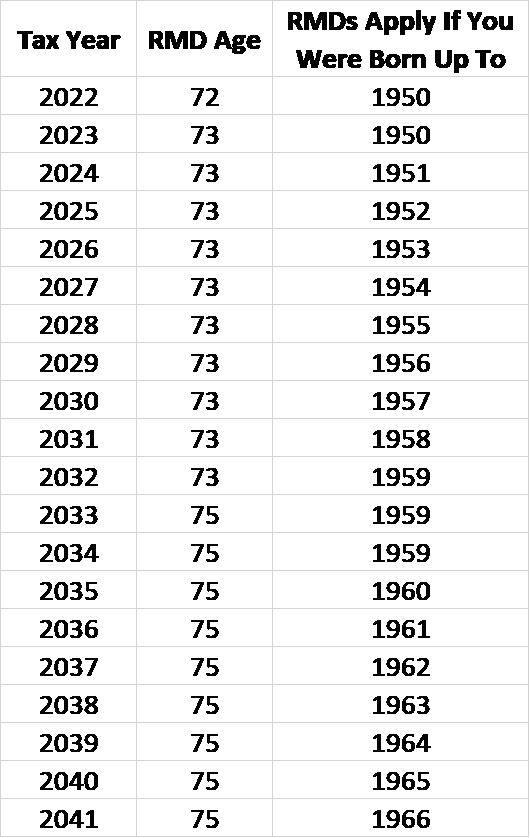

Fidelity Rmd For 2025. Rmd rules have previously applied to roth 401 (k) plans, but only up until the end of 2025. This calculator allows you to assist an ira owner with calculations of the required minimum distribution (rmd) which must be withdrawn each year once your client reaches age 73.

An rmd is the amount you must withdraw from your retirement accounts annually starting at age 73. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.

There are new required minimum distribution (rmd) rules as a result of the setting every community up for retirement enhancement act (secure act) for death benefit.

How Do You Calculate Rmd For 2025 Pauli Bethanne, That's up from the previous limit of $100,000. The rmd table the irs provides can help you figure out how much you should be withdrawing.

Rmd New Rules 2025 Glad Philis, Ira owner's date of death. That's up from the previous limit of $100,000.

Rmd For 2025 Table Marji Shannah, Your yearly rmd is calculated using a formula based on the irs’ uniform lifetime table. This calculator has been updated for 2025 to include 'secure 2.0' and irs notices from 2025.

How To Calculate An Rmd For 2025 Megan Sibylle, This guide will take you through how to use the rmd table,. There are new required minimum distribution (rmd) rules as a result of the setting every community up for retirement enhancement act (secure act) for death benefit.

-_FI.png)

Required Minimum Withdrawal 2025 Eddi Malorie, Your yearly rmd is calculated using a formula based on the irs’ uniform lifetime table. Learn about your options for required.

_Table.png?width=1578&name=IRA_Required_Minimum_Distribution_(RMD)_Table.png)

What Is The Required Minimum Distribution Age For 2025 Caryn Cthrine, Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. An rmd is the amount you must withdraw from your retirement accounts annually starting at age 73.

2025 Rmd Rule Changes Brook Concettina, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. It also predicts future distributions which can be used to plan ahead.

Fidelity non prototype account application Fill out & sign online DocHub, The cumulative rmds at fidelity investments, one of the. The rmd table the irs provides can help you figure out how much you should be withdrawing.

Clearing Up Confusion About RMDs Bulwark Capital Management, Use this calculator to determine your required minimum distribution (rmd). Your yearly rmd is calculated using a formula based on the irs’ uniform lifetime table.

What Is The Irs Rmd Table For 2025 Dulcia Hollyanne, This calculator has been updated for 2025 to include 'secure 2.0' and irs notices from 2025. Learn about your options for required.

2025 brings important changes to retirement plans that could help boost savings to retirement accounts and emergency funds as well as help paying off student.